Venezuelan and Iranian sanctions impact crude shipments

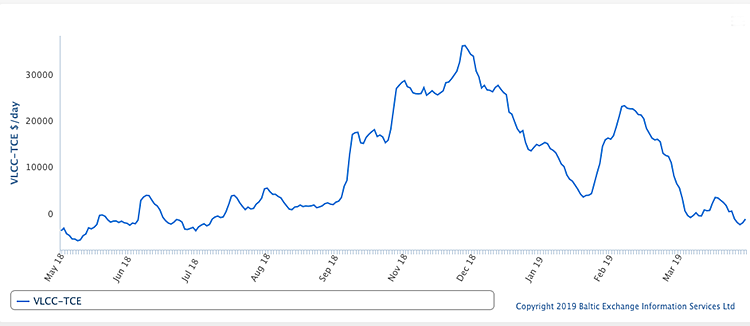

Spot rates for the largest very large crude carriers have revisited the extreme loss-making figures last seen in mid-2018, as overall seaborne crude flows contract and newbuilding deliveries remain at high levels

Average VLCC earnings touched minus $2,385 per day last week, according to the London-based Baltic Exchange, after briefly reaching $3,024 per day mid-month and have remained below zero this week

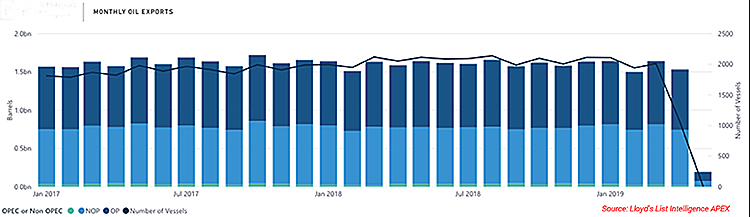

PLUNGING exports from Iran and Venezuela over April effectively removed some 732,000 barrels per day of crude from seaborne flows last month, which is the equivalent to needing 11 fewer very large crude carriers, data from Lloyd’s List Intelligence shows.

Exports last month from Iran are so far measured at 1m bpd using initial vessel tracking data. That compares with 1.71m bpd last month, data shows, and is the lowest monthly volume of shipments tracked from the country since 2016 when prior sanctions ended. Venezuelan exports also trickled lower, to 820,000 bpd, 18% below last month’s level.

April shipments show that refineries in Europe, India and China are purchasing Venezuelan crude or fuel oil, despite the imposition of stricter financial controls last week preventing sales using the US financial system.

US sanctions on Iran and Venezuela crude and petrochemical exports, combined with geopolitical unrest in Libya and the declaration of force majeure at a key West African terminal helped lift oil prices to fresh 2019 highs over the past weeks. But spot rates for the largest very large crude carriers have revisited the extreme loss-making figures last seen in mid-2018, as overall seaborne crude flows contract and newbuilding deliveries remain at high levels.

Overall monthly seaborne oil exports from the Organisation of the Petroleum Exporting Countries, of which both Venezuela and Iran are members, totalled 26.3m bpd on 1,058 tankers in April, according to Lloyd’s List Intelligence data. That’s the lowest volume in records going back to January, 2017.

By contrast, April 2018 Opec exports totalled 27.24m bpd on 2,052 ships, data show. Seaborne shipments from non-Opec exporters last month were at the lowest since October 2018, at 23.95m bpd on 656 tankers.

Average VLCC earnings touched minus $2,385 per day last week according to the London-based Baltic Exchange, after briefly reaching $3,024 per day mid-month and have remained below zero this week. Rates had been as high as $22,000 daily in March.

No Iranian-loaded crude has been tracked discharging from ports of the biggest buyers, China or India, since a 120-day waiver allowing eight countries limited imports expired on May 2. However, as many as a third of the Iranian-owned fleet transporting oil are not transmitting satellite signals preventing movements to be tracked, and hampering visibility.

Eight tankers that loaded last month in Venezuela have been tracked to destinations in northwest Europe or the Mediterranean, including two tankers that are signalling they will discharge their cargo at the port of Hamburg within the next week. Others have discharged at Gothenburg, Sweden, or at ports in Spain, Cyprus or Malta.

Only one Venezuelan-loaded vessel has sailed to the US Gulf — the aframax Seaoath. The tanker remains at anchor outside Houston port and has yet to discharge, possibly marking the last cargo for the US until the sanctions are lifted. A further six tankers with Venezuela crude that loaded last month are destined for India. Remaining vessels that are signalling a destination are heading for either Singapore or ports in China.