Tanker rates retreat as eastbound routes cool

Sanity returns to key routes with dirty tanker earnings sliding for a fifth consecutive day from last week's 15-year peak

Owners remain confident that a long-awaited tanker rates recovery will continue, although at more sustainable levels

DIRTY tanker earnings retreated for a fifth consecutive day and are now around one third of the levels achieved in last week's 15-year peak, although owners and brokers remain confident that the long-awaited recovery in rates will hold.

Fresh cargoes emerged mid-week that resulted in significantly lower deals being agreed between owners and charterers, returning sanity to key routes and arresting the dramatic plunges of prior days when vessels that secured stratospheric earnings last week subsequently failed on subjects.

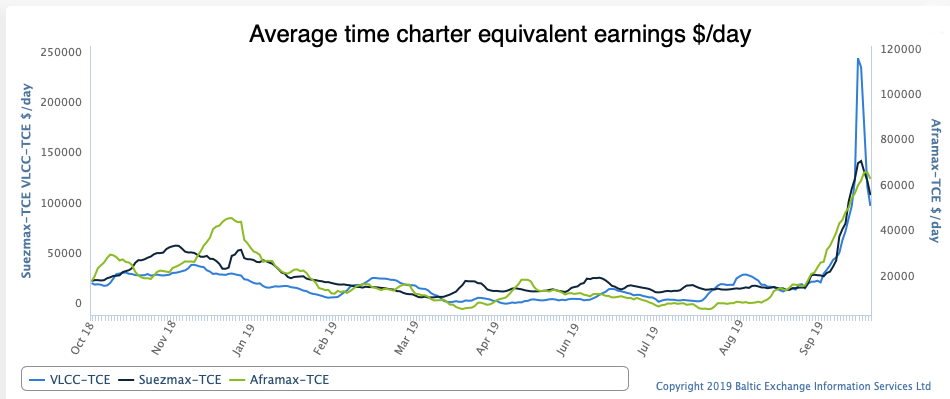

Spot rates agreed for several very large crude carriers last week soared five-fold in 10 days to the highest since 2004, with assessments from the Middle East Gulf and West Africa averaging more than $300,000 daily.

But the overheated market corrected sharply on Monday and Tuesday as many of these provisional deals failed if they were fixed above a $225,000 per day ceiling.

Thursday’s falls were between 32% and 10% on key VLCC and suezmax dirty tanker routes. Time charter earnings for VLCCs averaged $115,000 per day on the benchmark Saudi Arabia-China VLCC route, one third of the levels seen last Friday. The greatest falls were seen for VLCCs from West Africa to China, now around $107,000 per day, from $278,000 on October 11.

Despite these significant falls, owners remain confident that a long-awaited tanker rates recovery will continue, albeit at more sustainable levels.

Rates overheated after charterers avoided tonnage connected with sanctioned entities of China’s Cosco, imposed by the US on September 25 for shipping Iranian crude in defiance of unilateral sanctions.

Larger charterers were then reluctant to use tonnage that has called at Venezuela, also subject to US sanctions, removing as much as 15%-20% of VLCC and suezmax tonnage from the market.

Stena Bulk chief executive Erik Hannell told Lloyd’s List the market had been anticipating a recovery in rates by the third quarter, and the late-September rebound courtesy of Donald Trump provided a helping hand. Average VLCC rates were barely above breakeven levels for most of the second quarter and had barely broken $20,00 per day by mid-September, Baltic Exchange data show.

“The basic fundamentals are there,” Mr Hannell said, noting that most of Stena Bulk’s fleet, which includes 23 suezmaxes and 55 medium range product tankers, were trading in the spot market and therefore had cleaned up in past weeks.

“Rates will hold, probably not to this level, but they will be stronger — a lot stronger — than before… and think we will have an 18-months-long good time now.”

Shipbrokers are making similar upbeat assessments. “The underlying fundamentals remain strong, which will support a much higher floor for the balance of the year,” Oslo-based shipbroker Fearnleys said in a weekly report on Wednesday.

The report noted that many oil companies were now placing tonnage in the market to be chartered, with these additional vessels, known as relets, also helping alleviate the tonnage shortage that sanctions exclusion clauses had generated.

In clean markets, gains have been arrested by the collapse in the dirty market, except for larger aframax or long range two tonnage. This reflects the option for many of those in the fleet to switch to carrying crude where rates are higher, reducing available clean tonnage, and lifting rates.

Declines were seen in the benchmark medium range tanker Atlantic route to New York from Rotterdam, now at just over $18,000 per day, a $7,400 fall, according to the Baltic Exchange.

On the route to Japan from the Middle East Gulf, LR2 vessel earnings are averaging $73,650 per day. Rates were barely above $5,000 in mid-September.