Chinese owners and leasing banks dominate scrubber investment

Cosco Shipping emerges as the biggest backer with 113 vessels having scrubber technology fitted

Lloyd’s List Intelligence data on scrubber penetration shows at least 2,753 vessels, totalling 328.7m dwt, are now trading and have scrubbers installed

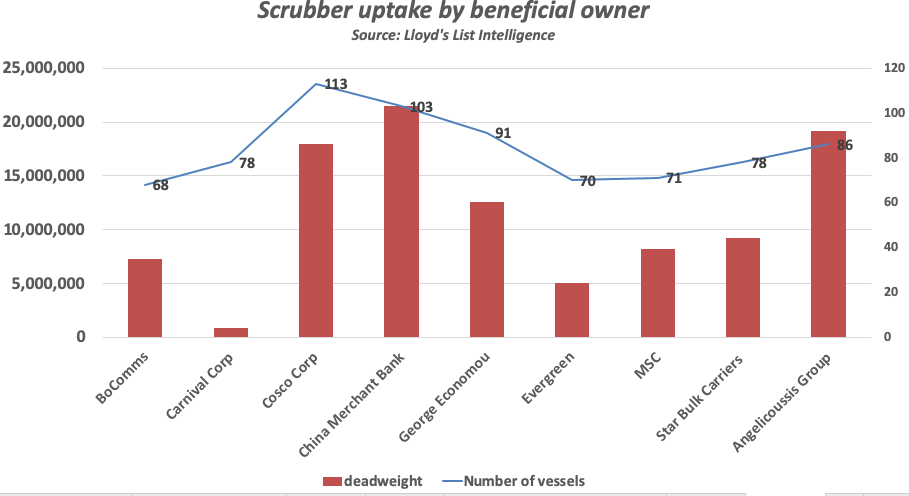

CHINA Cosco Shipping has emerged as the biggest backer of scrubber technology, with 113 vessels totalling 17.9m dwt fitted, analysis shows.

Along with China’s financial leasing banks, the world’s largest shipowner leads investment in the sulphur abatement technology, followed closely by container line Mediterranean Shipping, the Angelicoussis Group and George Economou.

Lloyd’s List Intelligence has collated data on scrubber penetration for the global shipping fleet, showing at least 2,753 vessels totalling 328.7m dwt is now trading and have scrubbers installed. A further 580 newbuildings are on order or under construction and will have scrubbers fitted, data show.

As well as revealing the fleet composition of scrubber-fitted vessels, the data also outlines the companies with the biggest bets on the technology, which allows them to use cheaper, 3.5% fuel oil and remain compliant with new global regulations to lower sulphur emissions.

In the container sector — where some 12.7% of the fleet by deadweight tonne have scrubbers fitted — Mediterranean Shipping Co has unsurprisingly largest volumes of scrubber-fitted tonnage.

Seventy-one vessels that it beneficially owns, including 13 passengerships, have scrubbers fitted. Total deadweight is 8.2m. This figure excludes other containerships that it operates under leaseback deals with Chinese banks. A further nine are with the Bank of Communications Financial Leasing and 10 with China Merchant Bank.

Taiwan’s Evergreen has 70 containerships of 5m dwt, while AP Moller-Maersk Group, the beneficial owner for the world’s largest container line, Maersk Group, has largely avoided the technology. Only 16 vessels of the 861-vessel fleet have the sulphur abatement technology. Thirteen are containerships, two crude tankers and the last a product tanker.

Chinese financial leasing houses are leading investment in scrubbers, which may indicate their tardiness in joining European banks that have signed up to the Poseidon Principles, which encourage green investment. There has been a rapid rise of the financial leasing structure over the past five years, particularly for top-tier shipowners. The bank funds the vessel with a leaseback deal structured so that the owner takes delivery, but with the leasing company still the beneficial owner.

China Merchant Bank is the beneficial owner of 103 ships, totalling 21.4m dwt. The Industrial and Commercial Bank also has 32 scrubber-fitted vessels on its books, for clients including Scorpio Tankers, BP Shipping and Vitol’s shipping arm Mansel. The Bank of Communications Financial Leasing has 68 vessels of 7.3m deadweight,

Bank of Communications Financial Leasing has 68 vessels of 7.3m dwt, including 22 that are operated by oil trader Trafigura, which recently sold off these leasing obligations to Frontline and Scorpio Tankers.

Scorpio Tankers, which has long championed its support for scrubbers, has 78 product tankers at just over 5m dwt.

George Economou is the biggest backer among Greek shipowners with 42 on bulk carriers and 48 on crude and product carriers, totalling 12.5m dwt. In terms of deadweight, the Angelicoussis Group is larger, with 19.2m dwt on 86 ships. Greek shipowners strongly opposed the introduction of the sulphur cap on marine fuels. Star Bulk Carriers, started by Prokopios Tsirigaki and owned by Oaktree Capital, has 78 bulk carriers of 9.2m dwt fitted with scrubbers.

Penetration by sector is 16.4% for crude tankers, 7.5% for product tankers and 12.2% for bulk carriers, measured by deadweight tonnage, Lloyd’s List Intelligence data shows.

From where marine fuel prices currently stand, those companies that have invested in the $2.5m-$3m cost of scrubbers are profiting from their decision, as higher fuel costs shrink earnings for those operating compliant, 0.5% low-sulphur fuel. In the world’s biggest bunkering port of Singapore, very low sulphur fuel oil is trading at $518 per tonne, compared with $320 per tonne, according to reported prices.

The spread, or difference in price, between 0.5% and 3.5% fuel oil is currently enough to return the scrubber investment for a very large crude carrier in about 18 months, analysis shows. However the spread has narrowed considerably over January, lengthening payback times.

“If too many owners scramble to purchase scrubbers, then high-sulphur fuel oil could become scarce and narrow the spread again,” said MorningStar Commodities Research in a February 3 report. “It is still early in the post-IMO 2020 scramble to predict long-term winners.”