Greek shipowner lifts Venezuelan crude after sanctions deletion

Aframax tanker owned by Eurotankers loads third cargo for China voyage after ship-to-ship transfer off Malaysia, vessel-tracking data shows

Another tanker from the Gotsis-family owned fleet was among six briefly sanctioned in June for shipping Venezuelan oil, in a shock move that also targeted three more prominent Greek shipping families

A TANKER operated by Eurotankers has loaded its third cargo of Venezuelan crude off Malaysia, five months after the US administration removed sanctions on another vessel owned by the same Greek family.

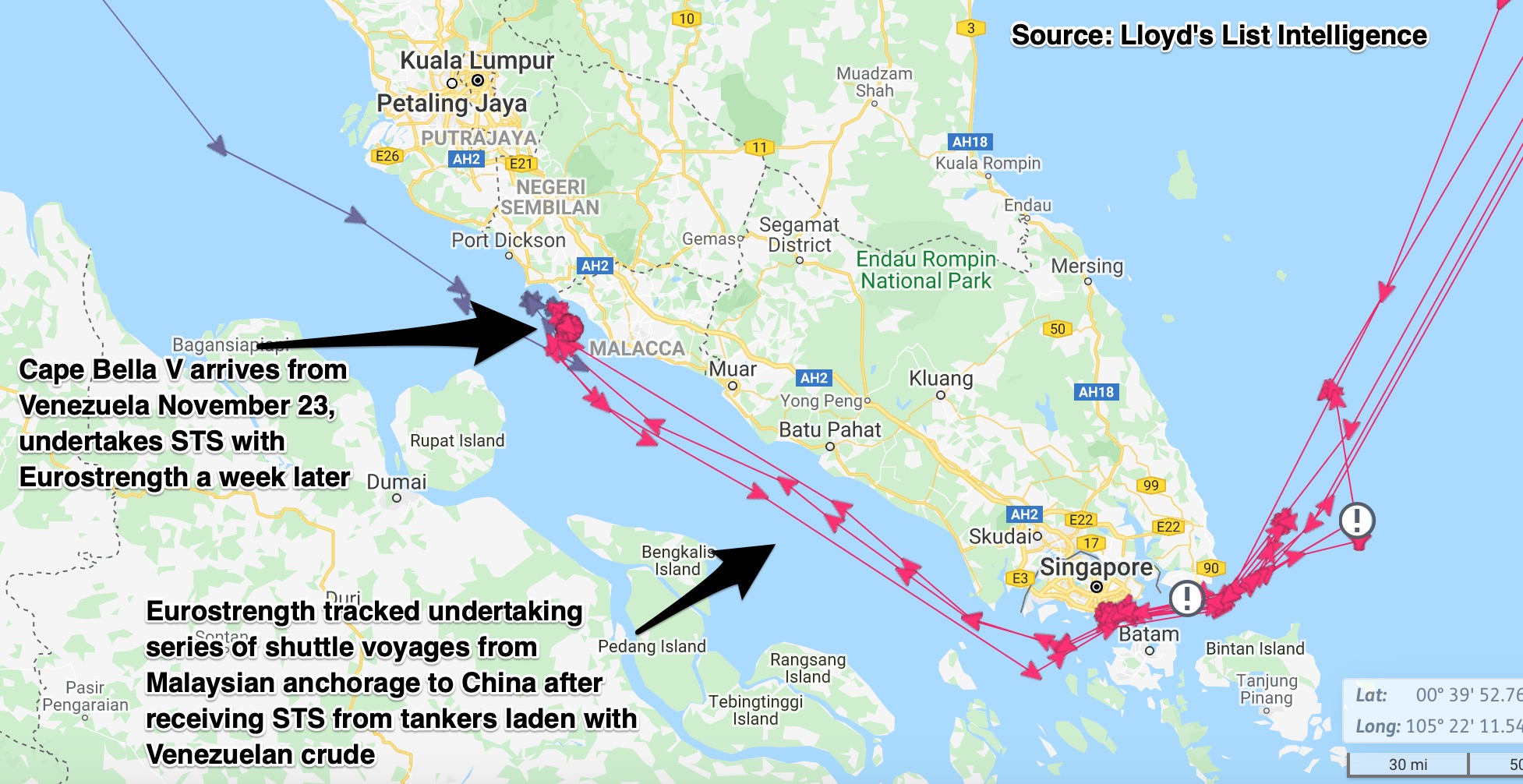

The 2012-built aframax ship, Eurostrength (IMO9543524), received an 80,000-90,000 tonnes cargo of Venezuelan crude via ship-to-ship transfer from the suezmax tanker Cape Bella V (IMO9232929) on November 30 in waters off the Sungai Linggi anchorage, according to Lloyd’s List Intelligence vessel-tracking data.

Cape Bella V loaded about 1m barrels via ship-to-ship transfer off Venezuela’s coast between September 27 and October 15, before sailing for the Malaysian waters, arriving on November 23. The suezmax loaded at the new Los Monjes ship-to-ship area, data show.

Another aframax tanker in the fleet, beneficially owned by the Piraeus-based Gotsis shipping family, was among six earmarked by the US for breaching Venezuelan sanctions over May and June.

The 2002-built aframax Euroforce was deleted on July 2, renamed Nabiin (IMO9251585) and registered a change of ownership before it resumed shipping Venezuelan crude.

Five other tankers linked to NGM Energy (Moundreas family), Chemnav Shipmanagement (Coronis family) and Dynacom Tankers Management (Prokopiou family) were also removed after being briefly sanctioned.

The selective targeting of single-purpose, shipowning shelf companies was viewed as a warning to the wider community of Greek shipowners who collectively transported 80% of sanctioned Venezuelan crude until then.

The vessel Eurostrength has shuttled at least two other cargoes of Venezuelan crude vis ship-to-ship transfers off Malaysia to China.

The first cargo discharged at a terminal near Sinopec’s Qingdao refinery in early October, and the last shipment arrived at the Longkou oil terminal around November 10, vessel tracking data show.

Eurotankers did not respond to Lloyd’s List requests for comment. There is no suggestion that any shipments breached US sanctions, or that vessels were engaged in deceptive practices.

At least five tankers in the Eurotankers’ fleet have been resold since June and resumed trading Venezuelan crude, data compiled by Lloyd’s List show.

US sanctions imposed on Venezuela’s oil and shipping sector from January 2019, alongside mismanagement and lack of maintenance, have decimated exports and oil production, estimated at 367,000 barrels per day in October. Production was nearly four times higher in 2017.

The US withdrew exemptions for non-US companies to undertake diesel-for-crude swaps in October, ending shipments to Indian and European refineries and further cutting off key markets to national oil company PDVSA.

Sanctions on trading companies operated by Russia’s Rosneft that were selling crude on PDVSA’s behalf, mainly to China, have also restricted sales.

That has pressured shipowners and buyers from chartering tankers to lift crude from Venezuela, with many ships instead resold to anonymous owners who then undertake the transaction.

Numerous changes in name and registry as well as tankers undergoing ship-to-ship transfers further obfuscate the origin and destination of cargo.