Shipping emissions rise 4.9% in 2021

Increase in carbon dioxide emissions represents ‘an inconvenient truth’ for IMO, says shipbroker

Rise to 833m tonnes in CO2 emissions seen despite intensifying regulatory landscape and reduction targets

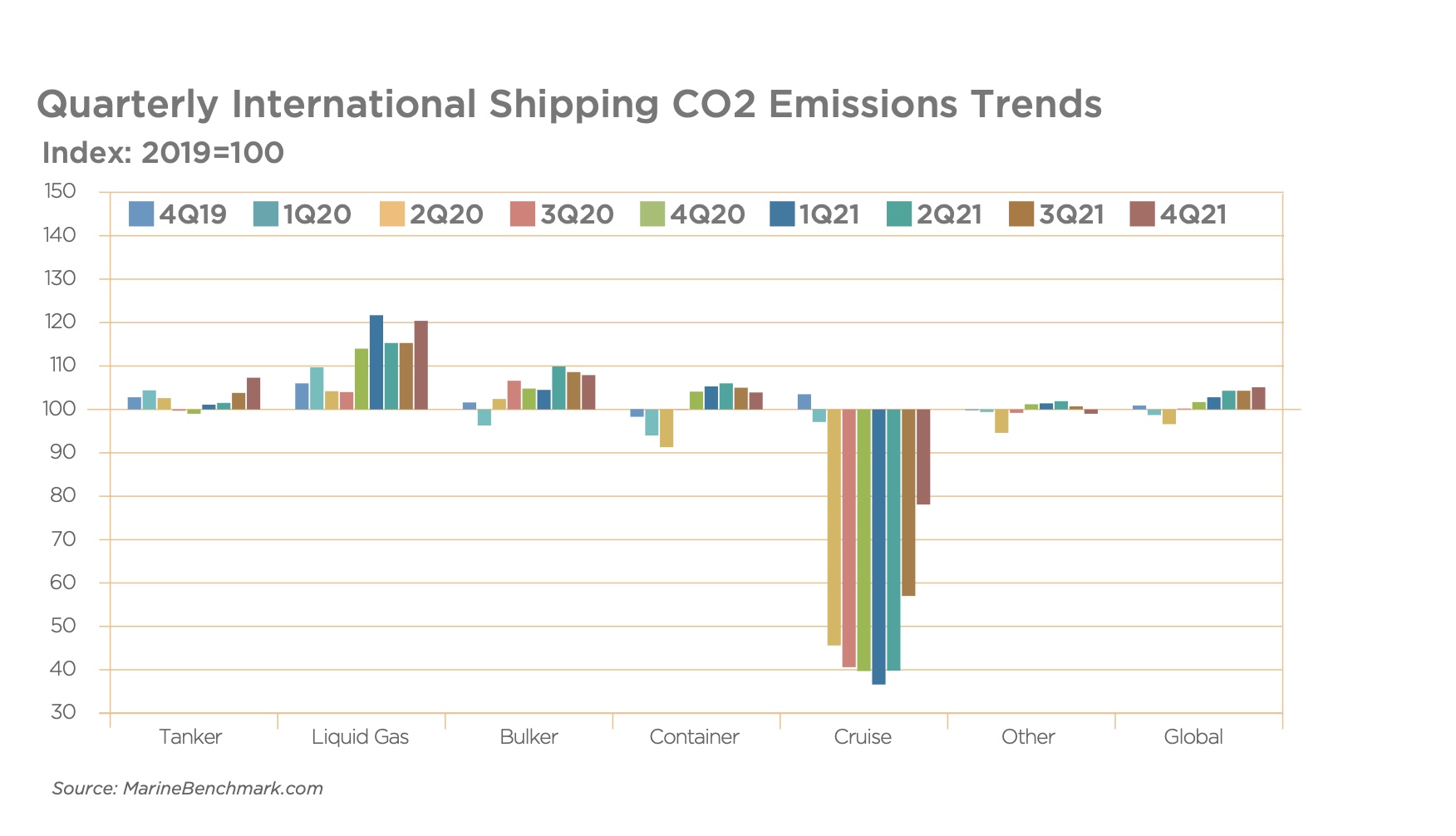

GLOBAL shipping’s carbon dioxide emissions posted year-on-year gains of 4.9% in 2021 and were higher than 2019, according to Simpson Spence & Young.

The rise in emissions over 2021 represents “an inconvenient truth” for the International Maritime Organization, the shipbroker said in its annual industry outlook.

The IMO has agreed to cut ships’ carbon intensity by 40% by 2030 amid intense criticism for failing to agree on further curbs that will meet international climate-change objectives.

The gains came despite what SSY said was an intensifying regulatory landscape for global shipping with looming limits on vessels’ energy and carbon intensity from 2023 and EU-based measures to include shipping in carbon emissions trading encourage the use of zero-carbon marine fuels.

Longer tonne-mile trades, higher sailing speeds for some vessel types and increased port congestion pushed emissions higher, the shipbroker said, citing data from Sweden-based MarineBenchmark.com.

Emissions increased most for the gas carrier fleet, followed by containership and bulk carrier emissions, with the global tanker fleet also lifting CO2 output as global oil demand recovered towards the end of the year, SSY said.

Emission estimates are based on automatic identification system movements and cover international shipping and vessels more than 100 dwt. In 2021, 833m tonnes of CO2 was emitted based, compared with 794m tonnes in 2020 and 800m tonnes in 2019, according to figures provided by SSY.

Shipping accounts for some 3% of the world’s emissions.

About 75% of the global fleet of bulk carriers and tankers will not be able to comply with new technical metrics mandated by the IMO and which come into force in January 2023, unless they take remedial action, the report said.

Vessels would have to sail at lower speeds or undertake other abatement measures to meet these Efficiency Index for Existing Ships and the Carbon Intensity Indicator goals. The metrics are calculated on service speed, design speed and deadweight.

“For most vessels, achieving EEXI compliance will have little bearing on actual vessel operations and leaves tangible CO2 reductions to a smaller number of heavily affected older vessels that are approaching retirement,” the report said.

“The CII ratings system may encourage more slow steaming from 2023 to limit CO2 emissions but, as we have seen in the 2021 bulker fleet, vessel speeds have been more responsive to market conditions than environmental objectives.

“Economising existing fleet emissions through the EEXI and CII might be a step in the right direction, but it also risks diverting focus from the overriding decarbonisation goal.”